By Michelle Crouch

Co-published with The Charlotte Ledger

Atrium Health, the state’s top collector of medical debt in recent years, has quietly stopped suing patients for unpaid medical bills.

The change was praised by critics who have long said it’s not right for a publicly chartered, multibillion-dollar, nonprofit hospital to take patients to court for medical costs that are often out of their control.

The Charlotte-Mecklenburg NAACP has been advocating for Atrium to end the practice for at least a decade, said president Corine Mack.

“When people are sick, the last thing they need to be concerned about is whether they are going to be sued for simply trying to get the help they need to stay alive,” Mack said. “Think of how hypocritical that is for a nonprofit to be suing people.”

Mack said she was encouraged that Atrium was finally doing the right thing, but she noted that the change won’t help hundreds of patients who still have judgments against them and liens on their homes.

Court records reviewed by The Charlotte Ledger/NC Health News show Atrium is still pursuing payment in those cases.

In an emailed response to questions, Atrium said it stopped taking patients to court for unpaid bills in November 2022 as part of its “journey in making health care more affordable” and in advance of its combination with Midwest-based Advocate Health.

“Atrium Health is continuously evaluating how we can best serve our patients and ensure equity in access to high quality care for all members of our communities,” Atrium said. (Read the full statement.)

Atrium made no public announcement about the change, and it went largely unnoticed until now.

Most hospitals don’t take patients to court

From 2017 to June 2022, Atrium filed 2,482 lawsuits against patients for medical debt – more than any other N.C. hospital, according to an August report from Duke University Law School and the office of State Treasurer Dale Folwell.

Even taking into account Atrium’s status as the state’s biggest hospital system, it was still responsible for a disproportionate number of cases, the study showed: Atrium filed 42 percent of the state’s bill-collection lawsuits and is home to 14 percent of the state’s hospital beds.

A majority of U.S. hospitals – including Novant Health, Duke Health and UNC Health in North Carolina – do not file lawsuits against patients over unpaid medical bills.

Those that do have come under fire in recent years as medical debt has become an increasing burden for Americans. More than half of U.S. adults said they have gone into debt because of medical or dental bills, according to a KFF poll.

It’s an especially acute problem in North Carolina, where about one in five families has medical debt in collections, according to data compiled by The Urban Institute. That compares to a national average of 13 percent.

“For some time, we’ve had a bunch of citizens coming to us to complain about how their credit was being ruined and how they were going into debt because of medical payments,” said George Dunlap, chair of the Mecklenburg County commissioners. “To know that Atrium is no longer doing that certainly lifts the burden for those being put in that position.”

Under-the-radar change

Atrium initially declined to answer questions about the new policy, but then reconsidered and sent its statement Friday afternoon.

It’s unclear if the new policy was voted on by the Charlotte-Mecklenburg Hospital Authority Board of Commissioners, the public body that oversees Atrium Health.

Board chair Angelique Vincent-Hamacher did not return a message asking for comment. William C. Cannon Jr., chair of the board’s finance committee, said all media requests had to go through hospital communications.

The billing and collections policy posted on Atrium’s website indicates it was revised on Oct. 1, 2023. It no longer lists lawsuits as a possible action the system can take. A previous version of the policy said accounts with balances of $300 to $5,000 may be referred to the local county small claims court, and balances above $5,000 may be subject to a lawsuit.

Atrium merged with Advocate Health in December 2022 to become the country’s third-largest nonprofit health care system, with $27 billion in annual revenue last year. Advocate’s current collections policy does not appear to allow for lawsuits.

Two Charlotte attorneys who represent clients with medical debt said they learned Atrium had stopped suing patients when The Ledger/NC Health News contacted them last week.

“That’s news to me,” said Rashad Blossom, a consumer law attorney in Charlotte.

Judgments last for 20 years

Blossom praised the policy change but added: “What about all the judgments and liens they have now that are good for up to 20 years? I have a client now who has a $50,000 to $60,000 judgment against her. If she wants to sell (her house), you better believe they (Atrium) are going to want some money from that.”

In North Carolina, judgments can last for 20 years and automatically place liens on people’s homes. They also accrue 8 percent interest per year as long as they remain unpaid.

Folwell, the state treasurer who has long criticized the state’s nonprofit hospitals, said in an interview he thinks Atrium should go further and also drop its judgments in older cases.

“(Atrium Health President) Gene Woods and his board of trustees at a snap of their finger could fix all of these problems,” Folwell said.

It’s not without precedent.

VCU Health, a large medical system in Richmond, Va., announced in 2020 that not only was it no longer going to sue patients, but it also promised to cancel claims related to old suits and remove thousands of liens against patients’ homes.

Just because a health care system stops filing lawsuits doesn’t mean it will stop trying to collect what it is owed. A hospital can still try to collect the debt itself, turn the debt over to a collection agency or sell the debt to a third-party debt collector.

Change comes too late for some patients

The Charlotte Ledger/NC Health News combed through court records to pull cases Atrium filed against patients in late 2022 and 2023. The records confirmed that the health care system filed no new medical debt cases in 2023, but still pursued patients to collect money on older judgments.

Sign up for our Newsletter

“*” indicates required fields

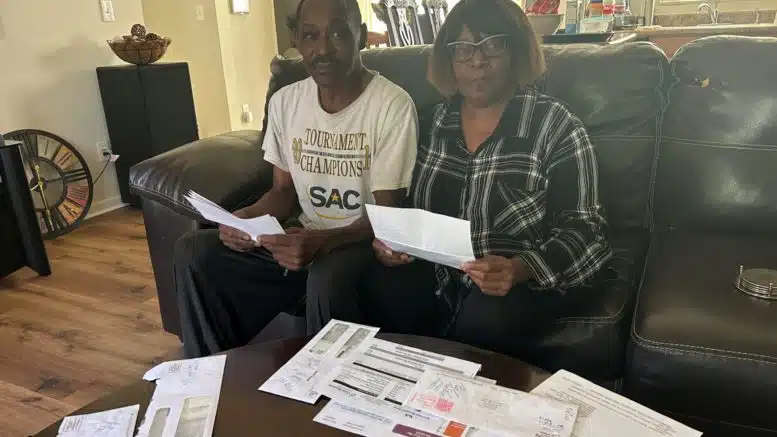

In February, for example, Lionel and Brenda White of Charlotte signed an agreement with Atrium’s lawyer and started making monthly payments toward $50,529 in debt, court records show. The agreement, called a Confession of Judgment, essentially puts any legal action on hold as long as they keep paying.

The Whites told The Ledger/NC Health News they felt like they had to sign the payment agreement with Atrium because they didn’t want to risk losing their house.

They said their medical bills mounted after Lionel had a seizure, a stroke and a heart attack in 2018, and he had to spend three days at Atrium Health Carolinas Medical Center.

The $50,000 they owe is more than either of them earns in a year, Brenda White said. She works as a transit supervisor at Family Dollar, and Lionel works at an airport restaurant.

When the Whites heard that Atrium was no longer pursuing patients in court, they called their contact at Atrium and asked if the hospital could forgive some or all of the debt.

He told them it wasn’t possible because the new policy went into effect after their case.

“That’s wrong,” Lionel White said. “I’m still paying, and they are forgiving all those other people. Why aren’t they forgiving us?”

Atrium’s statement did not respond to a question about whether they would consider dropping judgments and liens in previous cases such as the Whites.

Nonprofit hospitals receive millions in tax breaks

While hospitals are entitled to get paid, critics have said they think it goes against the institutions’ charitable missions to pursue patients in court, even as their CEOs make millions in salaries, perks and benefits. (Atrium CEO Gene Woods was paid $13.9 million in 2022.)

Nonprofit hospitals receive millions in local, state and federal tax breaks. As a public hospital, Atrium also enjoys other privileges, including property tax exemptions on properties that have little or nothing to do with the provision of health care.

Atrium officials said previously that they filed lawsuits only as a last resort, when patients didn’t qualify for financial help, didn’t apply for financial help or refused to communicate with them.

Two takes on Atrium’s financial assistance

In its most recent statement, Atrium said it doesn’t turn away anyone needing medical care, regardless of their ability to pay for care. If patients provide the proper information, Atrium can help patients “identify resources to help them resolve or even eliminate their debt.”

“We have a generous financial assistance policy, with free and reduced-price care available for those who qualify,” the hospital said. “ An average of 400 patients each day are pre-qualified for financial assistance and never receive a bill for the care we provide, totaling over $484 million each year.”

Leah Kane, an attorney with the Charlotte Center for Legal Advocacy, said some of her clients were never made aware of the hospital’s financial assistance program or were denied even though they are low-income.

“People are being denied just because they have insurance, even though they might have a $10,000 out-of-pocket payment,” she said. “From our perspective, they potentially aren’t handling charity care as well as they should.”

Proposed legislation that would have helped protect patients was introduced in the General Assembly this year, backed by Folwell. Among other provisions, the Medical Debt De-Weaponization Act would have capped interest rates on medical debt at 5 percent and required hospitals to provide free care to those whose household income is at or below 200 percent of the federal poverty level.

The bill was approved by the N.C. Senate but never got out of a House committee.

Her debt doubled in 10 years

The court records searched by The Ledger/NC Health News show that one of last medical debt case complaints filed by Atrium in Mecklenburg County was against Marcie Lynn Stafford in October 2022.

Stafford, 64, of Charlotte, owed $7,824 from a surgery she had back in 2012, and Atrium won a case against her that year. Because she never paid, the hospital system filed a new case 10 years later, called a “renewal,” to try to collect the money. It won that case last December, court records show.

Reached by phone earlier this month, Stafford told The Ledger/NC Health News she simply couldn’t afford to pay the bill. She also said she thought at the time that her health insurer was responsible for the payment.

She didn’t attend either court hearing and said she didn’t know the hospital had placed a lien on her house until she tried to sell it earlier this year.

Then, she was surprised to learn that instead of $7,824, she owed more than double that – $15,780 – because of interest and fees.

In July, she sold her home and paid off the debt, and Atrium closed her case. Stafford said she wished Atrium had changed its policy about lawsuits a little sooner.

“I’m having a hard time,” she said, “and I could have used that money.”

This article is part of a partnership between The Charlotte Ledger and North Carolina Health News to produce original health care reporting focused on the Charlotte area. For more information, or to support this effort with a tax-free gift, click here.