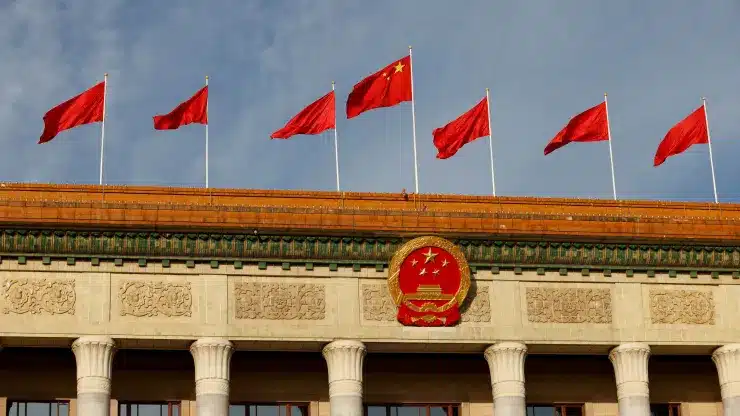

China’s annual parliamentary meetings are set to commence this week, drawing significant attention from investors eager for insights into potential economic stimulus measures. Notably, Beijing has deviated from tradition by announcing the cancellation of Premier Li Qiang’s customary press conference, a departure from previous years. Additionally, press conferences for the remainder of the current congressional term have been canceled, marking a significant shift in communication strategy.

While ministry-level press conferences on economic and foreign affairs are expected to continue, it remains uncertain whether the foreign minister will hold a press conference as in previous years. The premier’s press conference, regarded as a rare opportunity to engage with high-level leadership, has not been canceled since 1993, underscoring the significance of this decision.

Against the backdrop of China’s economic landscape, characterized by a GDP growth of 5.2% in 2023, questions loom over the pace of recovery following the COVID-19 pandemic. Challenges such as a downturn in the real estate market and decreased global demand for Chinese exports have dampened consumer and business sentiment, prompting speculation about the potential for substantial government intervention.

However, Beijing has thus far exercised caution in its approach to stimulus measures, signaling in December that any new policy support would be “appropriate.” Wang Jun, Chief Economist at Huatai Asset Management, emphasized the likelihood of a stimulus package smaller in scale than that of 2008, reflecting evolving economic conditions and policy considerations.

As China’s economic policy is typically delineated during the annual December meeting by leaders within the ruling Communist Party of China, the upcoming parliamentary meetings, known as the “Two Sessions,” assume significance at the governmental level. Anticipation surrounds the unveiling of policy plans, including the setting of GDP targets for the ensuing year.

Key areas of focus during the meetings include discussions on the real estate sector, capital markets, and local government finances. Notably, Beijing’s response to the financial crisis in 2008 involved a massive stimulus package, albeit criticized for exacerbating local government debt. In recent years, efforts have been directed towards mitigating financial risks and addressing the overreliance of real estate developers on debt for growth.

The parliamentary meetings are also expected to address plans to bolster technological innovation, aligned with broader initiatives aimed at enhancing “new productive forces.” While specific implementation details may be deferred to individual ministries, the broader policy directives emanating from Beijing will set the tone for future economic reforms and initiatives.

Amidst leadership reshuffles and ongoing efforts to strengthen governance structures, the outcomes of China’s parliamentary meetings hold implications for domestic and international stakeholders alike. Against the backdrop of evolving economic dynamics and global uncertainties, the decisions and policy pronouncements emerging from the Two Sessions will shape China’s economic trajectory in the coming year.